To ensure a common vision and synergy of practices within the banking group, the Compliance Department supports the group's entities on a daily basis in implementing compliance measures. Within each entity, a compliance manager functionally attached to the group's compliance director advises operational teams closely related to their professions.

This organization fully aligns with the collaborative and agile spirit of Crédit Mutuel Arkéa. Each employee plays a role in the process and contributes through their actions to the promotion of a common compliance culture and the mastery of non-compliance risk.

Building Confidence with Our Stakeholders

Compliance daily undertakes ethical and societal actions aimed at protecting the interests of clients while preserving the group's integrity and reputation. Compliance ensures regulatory compliance, informs stakeholders about issues and risks, and ensures adherence to professional best practices and information transparency.

Instilling a Common Compliance Culture

The Compliance Department acts as an advisor to both governance bodies and business operations to ensure the protection of all. Furthermore, it conducts training and awareness actions that contribute to the reinforcement of a common compliance culture, creating value and cohesion within the group.

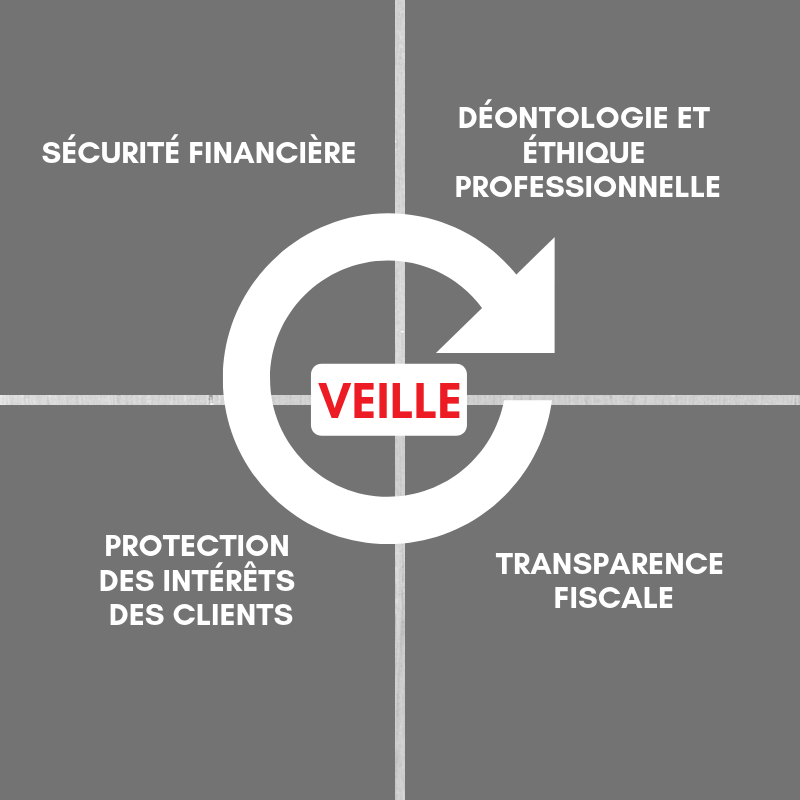

4 Areas of Intervention

Prevent, protect, inform, and regulate—compliance works daily to enable the company to adapt to changes in the economy and society. The prevention of non-compliance risk within the group revolves around four major axes:

-Financial Security (Anti-Money Laundering and Counter-Terrorism Financing, market integrity);

-Ethics and Professional Ethics (conflicts of interest, professional alerts, codes of conduct, anti-corruption, and influence trafficking);

-Customer Interest Protection (complaint handling, banking inclusion, prior approval of the compliance of new products, product governance, prescription, management of outsourced services);

-Tax Transparency (QI, FATCA, CRS).