Climate Strategy 2020/2024

At the end of 2019, Crédit Mutuel Arkéa validated a roadmap for integrating ESG issues at the heart of its financing and investment businesses.

Our ambition: to accelerate the move towards a more sustainable and long-lasting economic growth model, by taking extra-financial (ESG) issues into account alongside financial criteria.

Within this roadmap, the 2020-2024 Climate Strategy formalizes our commitments to transforming financing and investment practices with regard to climate issues. A climate report outlining our achievements in this area, meeting the recommendations of the TCFD (Taskforce on Climate-Related Financial Disclosure), has been published annually since 2021. We have also adopted various sector-specific policies, aimed at making concrete commitments to business transformation, such as phasing out coal by the end of 2027. These policies are regularly reviewed and supplemented by new commitments.

Governance Upholding Sustainability

Crédit Mutuel Arkéa is a cooperative and collaborative bank, now also a company with a mission, emphasizes strong identity translated through significant governance involvement and stakeholder mobilization in defining and implementing our strategy, objectives, and commitments. Since 2021, significant changes have been made to enhance the integration of sustainability issues into all decision-making within the group.

For examples:

- Governance bodies have included these issues in the scope of their missions, notably the Strategy and Corporate Social Responsibility Committee and the Risk and Internal Control Committee.

- Two ESG-climate reference administrators, Valérie Moreau and Monique Huet, have been appointed to the Strategy and CSR Committee and the Risk and Internal Control Committee

- Operational monitoring of actions is carried out by the Sustainable Finance department, regularly reporting progress on the roadmap to the group's governance bodies.

Training the governance on these issues is a key commitment of Crédit Mutuel Arkéa.

For examples:

- In 2020, members of the Board of Directors received training on climate issues for the financial sector, followed in 2021 by a module specifically dedicated to climate risk.

- In 2022 and 2023, the members of the Board of Directors, and then all second-level directors, received training on the subject of biodiversity and the challenges facing a financial player.

- In 2023, the Board of Directors was made aware of human rights issues with a view to adopting a dedicated policy.

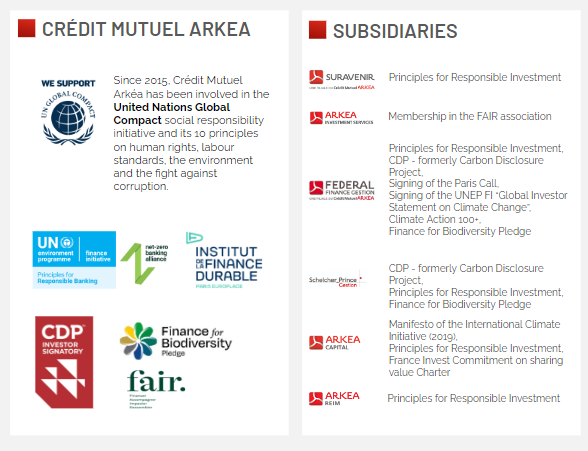

Support for Market Initiatives

Crédit Mutuel Arkéa and the group's subsidiaries participate in and support local initiatives and recognized commitments to Sustainable Finance:

Since 2015, Crédit Mutuel Arkéa has been committed to the United Nations Global Compact social responsibility initiative and its 10 principles around human rights, labor standards, the environment and anti-corruption.

Crédit Mutuel Arkéa is a member of the Institut de la Finance durable (sustainable finance institute) and actively participates in the workshops that bring together different players in the finance sector.

We have signed the Finance for Biodiversity Pledge and the Principles for Responsible Banking.

We support the CDP (formerly the Carbon Disclosure Project).

At the end of 2022, we joined the Net Zero Banking Alliance (NZBA).

Responsible approaches by activitie

Asset Management

ESG analysis is part of the DNA of Arkéa Asset Management (grouping of Federal Finance Gestion and Schelcher Prince Gestion). The integration of environmental, social and governance issues is adapted to each expertise. Arkéa Asset Management use a proprietary methodology and a "best-in-class" approach to select the most ESG-advanced issuers, with a specific approach for each asset class and each entity. A policy of engagement was introduced in 2018 to initiate constructive dialogue with certain companies whose extra-financial rating is well below that of their business sector. In particular, these exchanges are intended to encourage them to adopt more responsible policies and behaviors regarding extra-financial issues that are poorly addressed or not dealt with.

Arkéa Asset Management is also engaged in a labeling process for its funds.

Insurance

Suravenir, the insurance subsidiary of the group, and a signatory of the PRI since 2018, incorporates an ESG framework into its investment policy, including extra-financial risks in the investment process. To contribute to limiting global warming and reduce financial risks related to the energy transition, Suravenir published a climate strategy in 2021, aligned with that of Crédit Mutuel Arkéa incorporating specificities related to its business. For assets excluding Unit-Linked products, Suravenir relies on the ESG expertise of Federal Finance Gestion. Regarding Unit-Linked (UC) products, Suravenir limits new references to funds managed by PRI signatory management companies, and since January 1, 2022, those classified as Article 8 or 9 under "Disclosure." All contracts marketed by Suravenir include at least one SRI, Greenfin, Finansol, Relance, or "Low carbon" UC (Article 9 under "disclosure" with a greenhouse gas emissions reduction target). Suravenir Assurances has also integrated ESG criteria into its investment policy for proprietary investments. Financial investments are made through Federal Finance Gestion, according to its exclusion criteria (Global Compact, controversial weapons). To contribute positively to limiting global warming, Suravenir Assurances adopted a climate strategy in late 2022, covering its entire value chain (direct footprint, offerings, and investment policy).

Private Equity

Arkéa Capital has formalized its values and commitments through an ESG charter, confirming the sustainable development of territories as a major strategic axis, as well as the consideration of extra-financial criteria in the investment policy and support for companies in their ESG progress. Arkéa Capital integrates ESG criteria at each stage of the investment cycle. Arkéa Capital aims to support its investments in their CSR approach: for each new investment in which Arkéa Capital is the lead financial investor, the goal is to identify ESG improvement areas, co-construct a roadmap, and annually monitor its implementation. In 2022, Arkéa Capital formalized its 2024 climate trajectory strategy, which includes the ambition to support the environmental transition of investments. In 2023, Arkéa Capital defined its "Biodiversity Strategy 2030".

Responsible Financing

Arkéa Banque Entreprises et Institutionnels has implemented a qualitative CSR analysis framework for its counterparts for several years. Work has been done to strengthen this approach and build an ESG sectoral assessment grid, with a third-party ESG specialist. Deployed in 2023, it is a tool for both the company and the bank to identify the strengths of the company and its levers for improvement and increase its extra-financial performance. To specifically assess climate risk in credit granting, a questionnaire is progressively deployed since the second half of 2022 to companies in at-risk sectors and with more than ten million euros in turnover. To go further in supporting companies in their ESG approach, from 2020, the Pact Trajectoire ESG system provides for a reduction in the loan interest rate as soon as the client's ESG objectives (environmental, social, and governance) are achieved. In 2022, this system evolved to be made accessible to a greater number of actors. To ensure the neutrality of evaluations, Arkéa Banque Entreprises et Institutionnels relies on an independent extra-financial analysis agency that measures annual progress.

Institutional investor

Crédit Mutuel Arkéa's trading room applies the Group's tobacco, coal and fossil fuel policies to its cash management activities. Investment opportunities and limits granted by the Counterparties Committee are also defined according to an internal ESG rating assigned to the counterparties concerned.

Crédit Mutuel Arkéa's equity investments in companies and investment funds are also systematically subject to an ESG opinion.