Our key dates

Trois enjeux sont priorisés pour les années à venir : l’adaptation climatique, la biodiversité et le capital naturel, l’eau et les ressources naturelles, tout en veillant à une transition juste et à la souveraineté des territoires.

Ces trois enjeux font émerger un besoin de soutien aux solutions locales et d’accompagnement prioritaire de certains secteurs et projets concernés par ces problématiques sur nos territoires : agriculture, viticulture, agroalimentaire, immobilier, habitat, infrastructures : énergie, déchets, transport…

Our Climate Strategy

Our 2020-2024 Climate Strategy formalizes our commitment to transforming financing and investment practices regarding the climate challenge. In our latest climate report, aligned with the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD), Crédit Mutuel Arkéa aims for transparency in communicating information related to its activities and climate impact.

We strive for continuous improvement in combating climate change and evolving our business model to address these challenges.

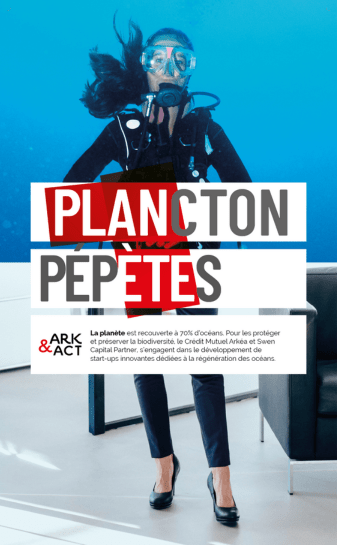

Beyond climate, we also place special emphasis on biodiversity. Crédit Mutuel Arkéa, Arkéa Asset Management have become signatories of the Finance for Biodiversity Pledge.

Guiding Environmental Transitions

The environmental challenges require a transition of business models, ensuring their economic sustainability. We aim to take responsibility for the significant role that our group must play in accelerating transitions, as an economic actor deeply rooted in local communities, in close proximity to its stakeholders. To support environmental transitions, particularly those of our clients and members, the Crédit Mutuel Arkéa Group is able to make an active contribution, whether it be financial – through investments, financing, for example – and/or non-financial, through advice and expertise.

Our Sector Policies

Facing climate risks and opportunities, the group and its subsidiaries commit to evolving their practices concerning the most emitting sectors.

Examples :

Investments Supporting Environmental Transition

Our support for environmental transitions is reflected in our investment and asset management activities.

For example:

- Crédit Mutuel Arkéa is a minority shareholder in the REV MOBILITIES group , supporting this French leader in retrofit technology (conversion to electric vehicles) in its development in France.

- In its cash placements, Crédit Mutuel Arkéa's trading room contributes to environmental transition by directing more investments towards Green Bonds.

Financing Environmental Transition

As a financier of the economy, we have adjusted our activities and offerings to support the environmental transition of our clients, including individuals, professionals, and businesses. The Crédit Mutuel de Bretagne and Crédit Mutuel du Sud-Ouest federations offer a range of loans aimed at financing greenhouse gas reduction actions for their individual clients. This includes financing for equipment that enables energy savings, both for primary, secondary, or rental residences (Rénovéo Loan) and the financing of electric or hybrid vehicles.

The consumer credit subsidiary, Arkéa Financement & Services, also positions itself in the home improvement market, with a majority of its activity generated by financing energy renovation projects. Arkéa Financement & Services has chosen to create specific products for electric vehicles. These two offers, Ma Garantie Véhicule Électrique (My Electric Vehicle Warranty) and Ma Révision Véhicule Électrique (My Electric Vehicle Maintenance), are only eligible for 100% electric vehicles.

Regarding support for the environmental transition of professionals and farmers, the Crédit Mutuel de Bretagne and Crédit Mutuel du Sud-Ouest federations support these actors with dedicated financing solutions for their projects in green energy production, energy renovation of their buildings to reduce water and electricity consumption, improvement of animal welfare and working conditions, as well as projects for the acquisition of more ecological vehicles or equipment.

Within Arkéa Banque Entreprises et Institutionnels, a dedicated Environmental Transition Department (DTE) was created in 2020. It supports SMEs, ETIs, local authorities, institutions, and real estate professionals in their environmental transition efforts. Renewable energies play a significant role in financed projects with mature technologies (photovoltaic, wind, hydropower, methanization, biomass, district heating, GNV stations, etc.). Energy-efficient building renovation is also an integral part of the activities of this sector.

Arkéa Banque Entreprises et Institutionnels offers several financing solutions: the Pact Trajectory ESG Loan, the tariff conditions of which evolve based on a periodic ESG evaluation conducted by a third-party organization, the Pact Carbon Loan, allowing voluntary clients to benefit from a carbon footprint assessment and an interest rate bonus based on the reduction of their carbon intensity, and the Arkéa Impulse Loan dedicated to financing environmental and social transition projects, with a duration of up to 25 years and enhanced conditions.

Non-Financial Support

The Crédit Mutuel Arkéa Group has always placed the support and assistance to its clients and members at the heart of its strategy. In the context of future transitions, this positioning is more relevant than ever and is manifested through various actions:

ESG Awareness: Arkéa Banque Entreprise et Institutionnels is implementing an enhanced approach to raise awareness and support its clients, businesses, and institutions on sustainability issues, including dedicated webinars and tailored solutions offered by the bank.

Agriculture - Viticulture - Agribusiness Policy: In continuation of the support policy for agricultural and viticultural operations adopted in March 2022, the Crédit Mutuel Arkéa Group has renewed its commitment to the Agriculture - Viticulture - Agribusiness sectors. It positions itself as a long-term partner to support actors in their transitions, including environmental transition, with special attention to global issues such as deforestation, biodiversity loss, and human rights. The group supports agro-responsible trajectories and the promotion of agro-ecological innovations, which involve agriculture practices considering environmental preservation, animal welfare, improvement of agricultural production, and the enhancement of farmers' working conditions. Beyond financing solutions, the group supports operators through co-financing.

Sustainable Housing Platform for Individuals: The two federations provide their clients and prospects with a tool that allows them to estimate the energy performance diagnosis of their homes, identify relevant works, know the associated aid amounts, and project the expected energy savings.

Arkéa Financement & Services launched Nidomio in 2023 to support customers in their energy renovation projects, whether they want to improve the comfort of their home while reducing their energy bills, or are looking to optimize their energy performance.

Client Savings Orientation

Supporting environmental transition also involves offering dedicated savings products. The various entities within the group work on creating, referencing, and distributing products that allow clients and members to align their savings with meaningful and potentially profitable solutions. This commitment is outlined in Crédit Mutuel Arkéa's Climate Strategy, emphasizing the mobilization of savings for energy and ecological transition by introducing green and innovative products across financial solution ranges.

Arkéa Asset Management developed savings solutions supporting environmental transition, such as the Arkea Global Green Bonds fund, Greenfin labeled, and the Autofocus Transition Climat funds, the first formula-based fund in the French banking landscape to obtain a label attesting to its responsible commitment.

Arkéa Asset Management Launched the Infrastructure Transition Platform in 2022, aiming to finance essential infrastructures for sustainable development, promoting the transition to a low-carbon model. Two multi-investor infrastructure debt funds were launched, incorporating ambitious goals of aligning funded projects with the European green taxonomy.

Structured Products for Individual Investors: The trading room of Crédit Mutuel Arkéa develops structured products for individual investors, marketed within the federations of Crédit Mutuel de Bretagne and Sud-Ouest, based on green bonds.