Engaging with the Paris Agreement

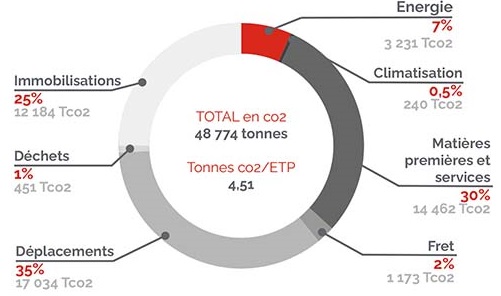

In line with our commitment to the Paris Agreement, we have identified five levers of action, translated into concrete measures for mitigating and adapting to climate change, in service of preserving natural resources. In 2022, the direct footprint of the Crédit Mutuel Arkéa group was estimated at a total of 48,774 tCO2e

Improving the "Home-Work Commute" Factor

We aim to leverage telecommuting to reduce commuting. The goal is to reduce our emissions by 4,500 tCo2e in 2024. The use of video conferencing and remote document-sharing tools has become widespread. In 2022, 95% of the group entities had a telecommuting agreement or were in the process of negotiating or renegotiating telecommuting. The Crédit Mutuel Arkéa also aims to change employee travel habits by supporting sustainable mobility with a target of reducing emissions by 1,500 tCo2e by 2024 (compared to the level observed in 2019). In 2022, we developed and updated our mobility plans. Charging stations for electric vehicles are also being deployed in the group's parking lots.

Reduced Professional Travel

Since 2021, Crédit Mutuel Arkéa has aimed for a 30% reduction in professional travel, maintaining this level each year until 2024. Employees are encouraged to favor video conferencing over travel. The group also aims to replace air and car travel with trains: 80% of trips lasting less than 3h30 should be by train. A 75% reduction in air travel on the Paris-Brest route is targeted by 2024. In 2024, the Crédit Mutuel Arkéa aims to have a fleet that is 100% hybrid/electric for low-mileage drivers (less than 25,000 km/year) and 50% for others. The fleet policy has been adjusted to encourage or require employees traveling less than 25,000 km/year to choose rechargeable hybrid or electric vehicles..

Responsible Supplies

In procurement, we aim to promote a responsible approach considering the environmental impact of purchased products and services, taking into account their complete life cycle. By 2024, our goal is to consume only certified and/or recycled paper. To reduce paper usage for clients, our primary lever is through the dematerialization and electronic signing of our offers, continuing in 2023. By 2024, we aim for 50% of new office supplies to be eco-designed. All internal and external goodies should be 100% plastic-free, eco-designed, or made in France. Different waste sorting systems exist within the group.

Sustainable Real Estate

Crédit Mutuel Arkéa constantly strives for the energy optimization of its buildings. The group has identified four axes for reducing emissions: improving building energy efficiency, sustainability, optimizing spaces, and exemplary constructions. As of the end of 2022, the group has accelerated its commitment to energy sobriety with the implementation of a sobriety plan for the entire group.

Responsible Digital Practices

Crédit Mutuel Arkéa has identified three axes for reducing emissions: rationalizing the IT fleet, improving data center energy efficiency, and promoting the use of responsible digital practices.

Skill Development

The group ensures to sensitize and educate all stakeholders on environmental issues and the fight against climate change. Board members, the executive committee, leading bodies of subsidiary entities, administrators, and employees regularly undergo training on environmental issues to better understand customer concerns.

Dedicated events are organized during seminars, supported by external consultants (climate issues applied to finance, climate fresco, etc.) and expert interventions (members of the IPCC, for example). Specific themes such as biodiversity are also addressed.

Measurement and Management

Greenhouse Gas Emissions Financed and Low-Carbon Alignment Trajectory

As part of its Climate Strategy, validated back in 2020, Crédit Mutuel Arkéa has committed to adopting a low-carbon alignment trajectory for its financing by 2030. This commitment has been strengthened by joining the Net Zero Banking Alliance (NZBA) in 2022.

As a financial player, the vast majority of greenhouse gas (GHG) emissions from Crédit Mutuel Arkéa's activities are linked to its financing and investments.

In December 2023, the Board of Directors of Crédit Mutuel Arkéa validated our first commitments to reduce emissions financed in so-called carbon-intensive sectors. These objectives set the course that will guide our actions in the medium term towards a more sustainable world. As part of a continuous improvement process, we will continue to contribute to the work being done in the marketplace, with the ambition of optimizing the measurement methodologies used and broadening the scope covered by new commitments. Our proactive approach echoes Crédit Mutuel Arkéa's status as a company with a mission, and demonstrates our group's commitment to transition.

These objectives are detailed in the January 2024 NZBA report .

Taxonomy

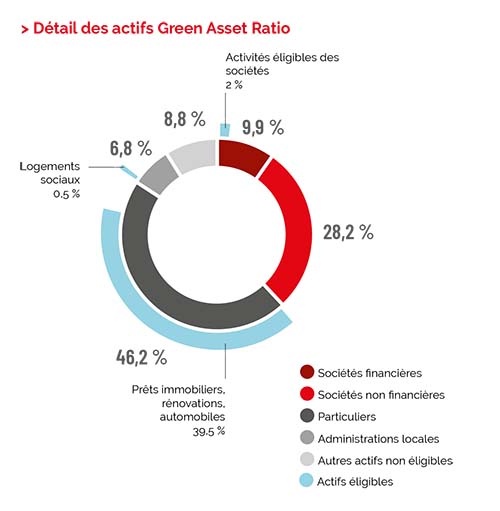

Since 2022, Crédit Mutuel Arkéa publishes the balance sheet portion associated with economic activities considered to have sustainable potential according to the criteria defined in the European taxonomy. As of December 31, 2022, activities eligible for taxonomy under the Green Asset Ratio were 42%.

| Article 8 de l’acte délégué du Règlement UE Taxonomie Publication sur base réglementaire | 2022 | 2021 |

| Activités éligibles à la taxonomie sur l'actif Green Asset Ratio (GAR) | 42% | 32% |

| Activités non éligibles, sur l'actif Green Asset Ratio (GAR) | 20% | 32% |

| Expositions aux Souverains, Banques centrales et émetteurs supra. nationaux sur l'actif total | 26% | 15% |

| Exposition sur les produits dérivés de couverture (hors trading book) sur l'actif total | 4% | 1% |

| Expositions sur les entités non soumises à la NFRD sur l'actif total | 22% | 24% |

| Portefeuille de transaction (trading book) sur l'actif total | 0% | 0% |

| Prêts interbancaires à vue sur l'actif total | 0% | 0% |

| Total Green Asset Ratio (GAR) en M€ | 100 029 |

107 900 |

| Total Actif en M€ | 136 640 |

127 706 |